Fintech Trades

Advanced Financial Data Insights with Pairs Trading Strategies

Equity Selection Engine

Fintech Wave Equity Index

Explore Our Top 20 List: Fintech Trades' Insights

At Fintech Trades, we operate on a simple belief: the market leaves clues.

Our core hypothesis is straightforward:

👉 Companies that score highly across financial strength, market sentiment, and predictive momentum are more likely to outperform in the near to mid-term.

To uncover these companies, we analyze:

-

Financial Performance – earnings trends, margins, cash flow efficiency

-

Market Sentiment – news tone, analyst commentary, social signals, options flow

-

Predictive Indicators – volatility behavior, technical momentum, pattern models

Each stock receives a composite score that reflects its overall momentum.

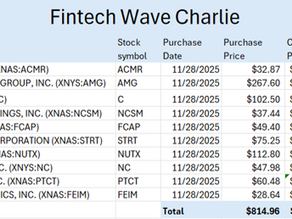

Those demonstrating consistent strength across all dimensions rise into the Fintech Wave indices—our data-driven view of tomorrow’s potential outperformers.

It’s not speculation.

It’s analytics, discipline, and listening to the story the data is already telling.

Great investment opportunities show measurable signals long before they gain mainstream attention. Our core hypothesis is straightforward: Companies that score highly across financial strength, market sentiment, and predictive momentum are more likely to outperform in the near to mid-term. To uncover these companies, we analyze financial performance, market sentiment, and predictive indicators. Each stock receives a composite score reflecting its momentum, forming the foundation of our top 20 list. Fintech Trades leverages these analytics to provide investors with actionable insights, fostering informed decision-making in an ever-changing market.